Why we are drawing attention to this topic:

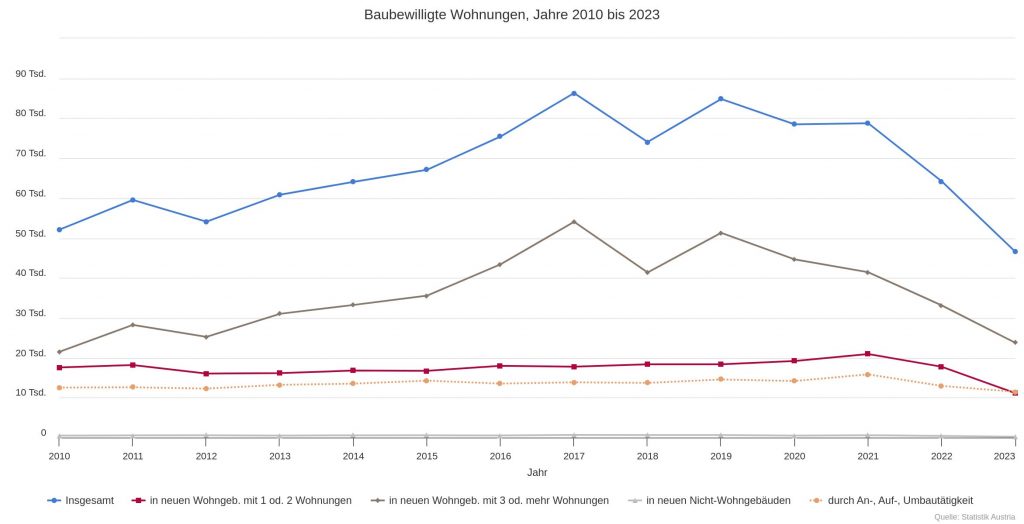

- During Covid, interest in real estate purchases has risen sharply. The interest rate trend, stricter lending guidelines and high construction costs are now leading to a reduction in construction activity.

- This is also having an impact on the rental housing market: In Vienna and the provincial capitals in particular, the increase in prices and demand is creating an increasingly tense situation. This affects the independent housing market as well as municipal and non-profit housing.

- Rents are a significant component of the cost of living. Rents in Austria have risen by 17% since 2020, driven by inflation. Low-income earners and low-income households are particularly affected by these increases.

- Lack of construction activity is also becoming a price driver in Germany.

Demand for rental apartments is on the rise: Increased interest rates on loans, stricter lending guidelines and economic uncertainty – these are the main factors cited by the ImmoScout24 portal in a recent analysis for the currently subdued purchase market in Austria. Reduced construction activity and fewer property purchases mean increased demand for rental apartments – by up to over a third, depending on the region.

Get part of your community!

Rents in the state capitals are also rising by up to 11 percent. Rents are driven primarily by the value protection clause, i.e. the automatic indexation of the rent. It is permissible in principle and was recognized as justified by the Supreme Court in 2019. The Chamber of Labor had initiated the proceedings at the time and argued that tenants were paying the rent for an increasingly ‘worn-out’ apartment. In turn, the Supreme Court argued that a tenant does not have to pay compensation for normal wear and tear.

As it is not so easy to intervene in private contracts, the only way to avoid index-linked rents is to have a functioning housing market with sufficient supply, said Holger Bonin, head of the Institute for Advanced Studies IHS, on Ö1 Morgenjournal.

In any case, the challenges remain in the medium to long term: Austria has to cope with strong immigration and the number of single households is increasing. Even those who cannot currently afford to own their own home will remain in the rental market.

This means that if we do not build enough, rents will continue to rise in the long term.

National climate plan: How Austria wants to reduce its CO2 footprint by almost half

Climate Protection Minister Leonore Gewessler presented the Austrian Energy and Climate Plan (NEKP) and will now submit it to the EU Commission.

This is the second attempt at a submission: Minister Gewessler first sent a draft to Brussels in December 2023, but it was withdrawn by European Affairs Minister Caroline Edtstadler (ÖVP).

AI for seniors: How artificial intelligence enables self-determined living

In view of the shortage of nursing staff, AI-supported assistance systems for the home are becoming increasingly urgent. In Germany alone, there will be a shortage of over 3 million homes suitable for the elderly and over 600,000 care workers by 2030. Technology that already provides support in care facilities is now also available on the market for private households.

This logic also applies to Germany. According to Engel & Völkers Residential’s analysis, there were price corrections in locations where the market was previously overheated. However, construction activity has slowed considerably because project developers are also suffering from the new financing conditions. Companies are also being hit by the significant price increases in construction costs, particularly the sharp rise in material and personnel costs. High wage settlements also play a major role here.

According to the Federal Statistical Office in Germany, around 50,600 fewer apartments were approved in the first half of 2023 than in the same half of the previous year, which corresponds to a decline of over a quarter. As project developers are struggling with economic difficulties, projects are also being canceled – which means that housing subsidies are not helping to change the trend. Experts anticipate a further increase in housing pressure and thus a further rise in residential real estate prices.

Analysis of the ImmoScout24 platform

To the analysis of real estate prices by Engel & Völkers

To the Ö1 Morgenjournal from 14.5. 2024, Interview with Holger Bonin

Photo credit/image above: Shutterstock